Understanding the emotional landscape of cryptocurrency traders

The cryptocurrency market has become increasingly volatile and unpredictable in recent years, leading to the increase in the number of traders who are ready to post their emotions on the line. While some consider cryptocurrency trade as separated persecution, others are deeply invested in markets driven by emotions such as fear, greed, excitement and excitement.

Cryptocurrency Trade Psychology

Studies show that individual behavior and psychological factors play an important role in determining whether traders are successful or unsuccessful in their efforts. One of the main factors is the level of emotional controls on the merchants. Emotional traders trading with intense passion and enthusiasm tend to work better than those trading with more mansion approaches.

Greed: Main Emotional Merchants

One of the common features of successful cryptocurrency traders is their ability to experience greed. Greedness can manifest in a variety of ways, such as feeling confident in their transactions or making impulse decisions based on short -term benefits. However, excessive greed can lead to release and significant losses.

Fear: awkward truth

The opposite of greed is fear – an important aspect of the emotional landscape of many traders. Fear can make individuals be cautious when hesitating to invest or trade first. As a result, they can miss lucrative opportunities due to their reluctance to take risks.

Enthusiasm and rights

Some merchants are concerned about how their transactions are expanding, partly as their contribution is about to pay off. However, this sense of excitement can be misinterpreted as rights, forcing them to become confident in their trade abilities. If this belief turns into arrogance, it can quickly cause disappointment and loss.

Anxiety and Stress

For many traders, cryptocurrency markets are unpredictable and chaotic. As a result, they may have a high level of alarm when market fluctuations affect their investment. This emotional reaction can be manifested as fear, excitement, or just despair – all of which can worsen trade decisions.

Breaking emotional barriers

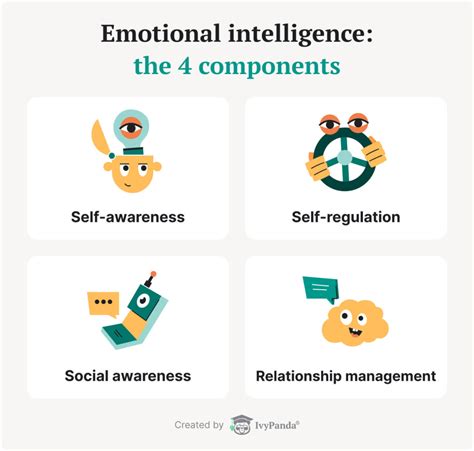

It is important to develop emotional control and discipline in order to succeed in the world of cryptocurrency trade. Here are some strategies that can help:

* In practice, self -esteem

: Recognize when emotions drive your behavior and take steps to manage them.

* Develop a consistent strategy : stick to the exact plan to reduce the impact of emotions on trade decisions.

* Focus on the basics : Focus on the basic principles of principles, not emotional triggers.

* Set clear goals : Create special goals for your trade activities and track progress towards them.

Conclusion

The emotional landscapes of cryptocurrency traders are complex and multifaceted. Understanding these underlying factors can help individuals develop a more effective approach to trade only in the face of uncertainty. By recognizing and managing their emotions, traders can increase their opportunities for success and build long -term relationships with the markets with which they each day.