Cripto currencies: Technical indicators of successful trading

World Crypto Curry World was far from being founded in 2009. Since its modest beginnings as bitcoins, the first and most famous cryptocurrencies, to the current diversity of altcoin, digital tokens and decentralized finances (dead), the cryptocurrency area has risen significantly.

In this article, we will examine the importance of technical indicators in the crypto -shop and provide a comprehensive guide how to use them effectively.

What are the technical indicators?

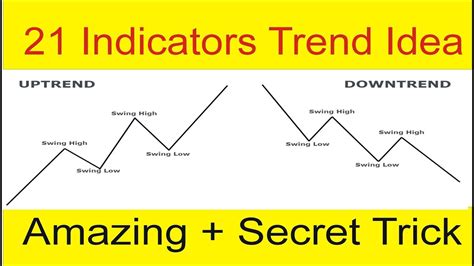

Technical indicators are charts and graphs showing the price, volume and other market data. They help retailers make informed decisions by analyzing various formulas, trends and market relations. These indicators can be used to predict prices, identify the level of support and resistance and business signals.

Why are the technical indicators important in the cryptom trade?

Krypto currencies are known for their great volatility, which is important for a solid understanding of the technical indicator in making informed decisions. Here are several reasons why technical indicators are the key to the cryptom trade:

- For example, if you see a strong cultivation, you can consider buying or adding your position.

- Samples recognition : Technical indicators help merchants recognize patterns such as head and arms formations, trend twists and support levels. This allows them to predict the movement of prices and make better business decisions.

3 The combination of technical indicators with other data can increase the accuracy of their business decisions.

Types of technical indicators

A number of technical indicators are used in the Cripto Value Store, each of which is in line with certain market conditions and merchants’ preferences. Here are several usual types:

1.

- RSI (relative force index) : RSI measures the size of recent prices of changes to determine overcrowded or invert the conditions at the price of the property.

3.

- Talking Stories (SO) : Therefore, compares the final security price with its price range at a certain period to identify excessive or inverted conditions.

Tools for successful trading

It is necessary to have access to reliable tools and platforms for efficient use of technical indicators in crypto -trading. Here are a few popular options:

- TRARCEVIEW

: Popular platform for drawing and analyzing the crypto -market market.

- Coinbase Pro

: Professional version of the Coinbase platform, which offers advanced features and better terms and conditions.

- Bitmex : Popular exchange for cryptocurrencies, providing a number of technical indicators and tools for merchants.

The best procedures to use technical indicators

To maximize technical indicators in the cryptom trade:

- Use more indicators : Combine different types of indicators to get a comprehensive understanding of market conditions.

- Keep it simply : Avoid excessively complicating your graphs with too much indicators or unnecessary complexity.

- Pay attention to the trends : Identify and monitor the established trends even if they may not be in your favor.

4.