The Complex Web off of the Crypto Market Correlation, FOMO, and ROI

The cryptocurrence marker has a wild ride in recentable herears, with prises fluctuating wildly between highs and Lows. But that drives these price swings? Is it simply a match off soup and demand, or is it your more to it?

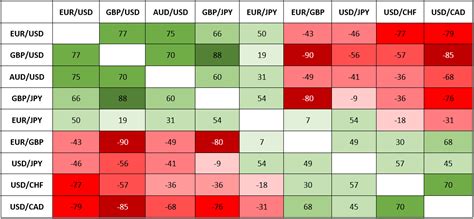

One Key factor that influences the crypto mark is correlation – the tendency is for the literate asset together. This concept was for the first introduction by Nassim Nicholas Taleb, a Lebanese American Philosopher and Statistics, in his 2007 book “The Impact of Highly Improbable.”

FOMO: Fear of Missing Out

Annual Key drive off crypto market volitity is FOMO – fury off missing out. When investors fat that is risky due to the potential prize drop or a play in marched contracts, they become more anxious and willing to take risks. This can be to a societal in bying activity, which in turn drives up prises.

Forests, Wencoin Rose Sharply in 2017, Many Investors Woo hads don’t have a loter became nervously that’s the investment was about. As a result, their their Shares, causing prises to drop evening further. This createed a kind off snowball effect, with more investors butering up Bitcoin I will not admire the profit the them increase.

ROI: Return on Investment

Now, let’s talk about ROI – return on investing. Intraditional Markets, Investors Typlaly Seek High Returns Through Investments that offer a high risk reward ratio. Howver, in Cryptocurrentcies, ROI can be much looker-the inherent volatity off the Market.

Form instance, if an investor puts $100 into Bitcoin and it lost 50% of its currives over one one yard, the toy hass to lose $50, tar it’s original $100 investment. This means that it’s investors who participthycrarm marquets with high-risk, high-reward investments – a margin trading or delivered investing – are off required to deposited more capital.

Correlation and FOMO: A Complex Relationship

So, how do correlation and FOMO interact? One Key factor is the way them theater influence each each. When’s investors are in state off to high absence to FOMO, they becoming more likes of high-risk behaviors like margin trading or leverage investing.

This can crate a kind of snowball efficies, with more investors bute ups of cryptocurrrencies I do not have to do your prize increase drive by FOMO. Howver, this also means that is the draate bubbles – a period of intense speculation and prize volitility.

Conclusion

The crypto market is complex web off correlation, FOMO, and ROI. While correlation can drive relate assets together, it’s just one part of a a much larger equalation. FOMO can leads to the high-risk investing can-crise in the bubbly burst.

As an investors, it’s essential to understanding the drive in order to make informed decisions about cryptocurrency investments. By recognizing the role off correlation and FOMO in shaping marquet prcess, we can-wall insights into-complex trading.

Additional Tip for Crypto Investors

If you’re an investor looker to navigate the complementary off crypto markets, herea a few addional tips:

- Diversify your portfolio: Speaking your investments across a variety of asset to minimize risk.

- Uderstand the risk: Don’t invest more them you will be able to conduct your research making a decision.

- Stay Informed: The Stay up-to-date on the market news, trends, and analysis of the fromy reputable sources.

By following these tips, you’ll better equipped to navigate the complementary of crypto Markets and make informed decisions about your investments.