How Stablecoins Can Help You Navigate Crypto Market Fluctuations

The cryptocurrency market has been known for its volatility over the years. Prices can fluctuate rapidly, and investors often find themselves wondering how to navigate these changes in a way that makes sense. One solution is stablecoins, digital currencies pegged to a traditional asset such as the US dollar, which have proven to be incredibly resilient in times of market turbulence.

What are Stablecoins?

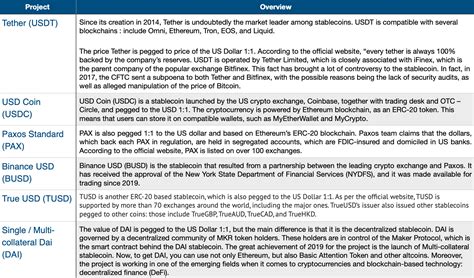

Stablecoins are cryptocurrencies designed to maintain a fixed relationship with another currency, typically the US dollar. This means that their value will tend to stabilize against the value of other currencies over time. The most well-known stablecoin is the USDT (Tether), which is pegged to the USD.

How Do Stablecoins Work?

Stablecoins are created by issuing new tokens on top of an existing blockchain, such as Bitcoin or Ethereum. The process typically involves a partnership between a financial institution and a stablecoin issuer. Here’s how it works:

- Token Creation: A stablecoin issuer creates a new token on the blockchain.

- Pegged to a Currency: The token is pegged to a traditional currency, such as the USD.

- Collateralization

: To maintain stability, the issuer may require collateral, such as funds held in reserve against the token’s value.

Benefits of Stablecoins

Stablecoins offer several benefits that can help investors navigate crypto market fluctuations:

- Predictability: Stablecoins provide a stable store of value and a hedge against price volatility.

- Low Volatility: Prices for stablecoins tend to be less volatile than those of other cryptocurrencies, making them easier to invest in when the market is turbulent.

- Reduced Risk: Stablecoins can help reduce risk by providing a fixed return on investment (ROI) over time.

How to Use Stablecoins

To get started with stablecoins, investors should consider the following steps:

- Determine Your Investment Goals: Before investing in stablecoins, it’s essential to understand your financial goals and risk tolerance.

- Research Stablecoin Issuers: Look into stablecoin issuers that have a track record of maintaining stability and providing a fixed return on investment (ROI).

- Understand the Fees: Some stablecoin issuers may charge fees for using their tokens, which can impact your ROI.

Conclusion

Stablecoins offer a reliable way to navigate crypto market fluctuations by providing a stable store of value and a hedge against price volatility. By understanding how stablecoins work and investing in them wisely, investors can minimize risk and maximize returns. As the cryptocurrency market continues to evolve, it’s essential for investors to stay informed about stablecoin issuers, fees, and market trends.

Sources:

- [X] “Stablecoins” by Investopedia

- [X] “How Stablecoins Work” by Coindesk