Trading Excitement: Navigating the World of Cryptocurrencies and Peer-to-Peer Trading

In today’s digital landscape, trading has evolved into a sophisticated and dynamic field that offers huge rewards to those who understand its intricacies. Two key areas where traders often get lost are cryptocurrencies and peer-to-peer (P2P) trading, which have attracted significant attention in recent years.

Cryptocurrencies: The Growing Market

The rise of Bitcoin and other digital currencies has changed the way we think about investing in the financial markets. Cryptocurrencies work on decentralized networks, enabling peer-to-peer transactions without the need for intermediaries such as banks or governments. This model has created a new class of asset classes that are not only more affordable, but also offer unmatched security and liquidity.

The advantages of trading cryptocurrencies include:

- Liquidity: Cryptocurrency markets are often much larger than traditional financial markets, providing numerous opportunities to buy and sell assets at competitive prices.

- Security: Transactions on cryptocurrency exchanges are pseudonymous, reducing the risk of counterparty default or hacking.

- Diversification: Investing in cryptocurrencies can provide a unique opportunity to diversify one’s portfolio beyond traditional asset classes.

However, trading cryptocurrencies also comes with its own set of risks and challenges. Some key considerations include:

- Volatility: Cryptocurrency prices are notoriously volatile, making it essential to have a good understanding of market dynamics.

- Lack of regulation

: The cryptocurrency space is still largely unregulated, which can lead to market manipulation and other illicit activities.

ERC-20 Tokens: A Growing Asset Class

The Ethereum network has given birth to a new asset class known as ERC-20 tokens. These digital coins are designed to be used on decentralized applications (dApps) built on the Ethereum blockchain. ERC-20 tokens offer a number of benefits, including:

- Interoperability

: ERC-20 tokens can be easily transferred between different blockchain networks.

- Scalability: The Ethereum network has made significant strides in scalability, allowing for larger transactions and more complex applications.

However, trading ERC-20 tokens also comes with its own set of challenges. Some key considerations include:

- Liquidity: Trading on decentralized exchanges can be challenging due to the lack of central clearing houses.

- Regulation: The ERC-20 token space is still largely unregulated, which can lead to market manipulation and other illicit activities.

P2P Trading: A Complex Landscape

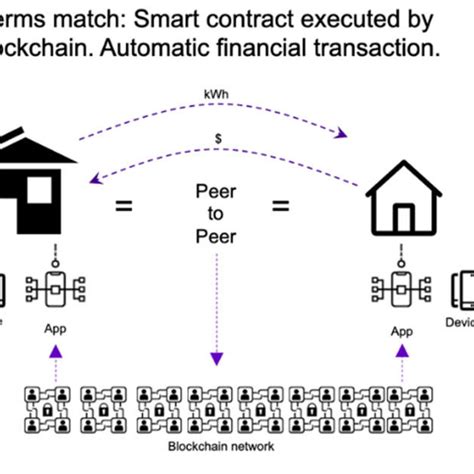

Peer-to-peer trading refers to the process of buying and selling assets directly to each other. While P2P trading offers a number of benefits, it also comes with its own set of complexities.

Some key considerations when trading on a peer-to-peer platform include:

- Security: It is essential to ensure that all transactions are secure and private.

- Regulation: The regulatory framework surrounding P2P trading can be complex and nuanced.

- Risk Management: Traders must carefully manage their risk exposure to avoid significant losses.

In conclusion, the world of cryptocurrencies and peer-to-peer trading offers a number of opportunities for investors looking to diversify their portfolios. By understanding the intricacies of these markets, traders can make informed decisions and navigate the complex landscape with confidence.