Title: The attraction of Aths: unpack the power of the performance of the cryptography market and their impact on commercial psychology

Introduction:

In the constantly evolving landscape of cryptocurrency markets, price movements can have a deep impact on merchant decisions. Among these important oscillations, there is the so-called “high-end” (ATH), where the value of a cryptocurrency increases at unprecedented levels before reverse its trend. These ATHS are often followed by an accident, which makes them very volatile and attractive for traders opposed to risk in search of stability in uncertain markets.

What are the Aths?

A summit of all time is the highest price reached by cryptocurrency for a long time, generally several months or years. This event marks a significant market movement, signaling substantial changes in the feeling of investors, market conditions or both. When ATHS occur, it is not uncommon to see traders and investors rushing to buy on the market at prices away from their previous summits, only to see the price drops quickly.

Psychological impact on trading:

Trading psychology is deeply influenced by the market environment, including ATHS. Traders can experience a range of emotions during these periods:

- Fear and greed: Traders may be afraid of missing (FOMO) or too optimistic when they see prices increase rapidly at ATH levels.

- Excess of confidence:

The power of Aths can lead certain traders to become too confident in their market forecasts, neglecting fundamental analysis.

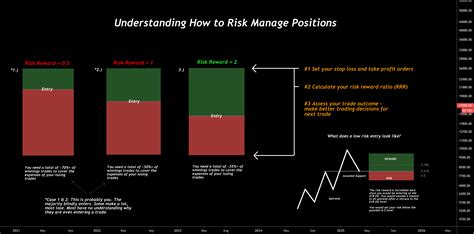

- Risk-reversal ratio: As Aths signals significant price movements, traders can be tempted to increase the size of their position or take more risk due to the perceived potential for higher yields.

The Risk-Recompress report:

The Risk-Recovense Report is an essential component of commercial psychology. When ATHS occur, it is not uncommon for investors and traders to apply swollen margin in their positions, pulled by excitement and optimism surrounding these events.

For example, if a merchant buys 10 BTC at $ 50,000 and expect prices to increase $ 100,000, he could consider increasing his position size to 20 BTC (200% of the initial investment) . This decision can cause significant losses if the ATHS materialize and prices do not follow expectations.

Little risk:

Although ATHS can be attractive for merchants looking for high yields, it is essential to maintain a risk-re-competence state of mind. Traders should:

- Define realistic expectations: Understand that ATH are short -term price movements and do not guarantee future performance.

- Diversify: Divide investments on various assets to minimize exposure to a market or a trend.

- Monitor fundamental analysis: Focus on long-term fundamentals, such as the health of underlying technology or economic indicators, rather than short-term market fluctuations.

Conclusion:

The high phenomenon of all time offers a unique window on trade and risk management psychology strategies. By understanding psychology behind the ATH and maintaining a risk-reaches reporting state of mind, traders can navigate in these complex markets with greater confidence. However, it is crucial to remember that even in Aths, caution must always be exercised, because the markets are intrinsically unpredictable.

Additional advice for merchants:

–

Stay informed but avoid emotional decisions: Stay up to date with news and market analyzes while retaining emotional control.

–

Have a trading plan: Develop a clear strategy before entering the market to minimize risks and maximize potential gains.

–

Manage your emotions: Recognize that trading is a marathon, not a sprint. It is essential to keep the pressure under pressure.