Use of order flow to improve insight into trading in the Crypto Currency

Crypto currencies were hot goods in the financial world, and prices quickly and unpredictable fluctuating. As a result, traders and investors are constantly looking for new ways to get the advantage over their opponents. One such method is the use of the flow of order flow information on trade decisions information. In this article, we will investigate how cryptocurrency traders can use the order flow information to improve their insights and make informed trading decisions.

What is order flow?

Order flow refers to the number of crafts executed at a specific price level. This is basically a recording of all the commands set at that moment. These data provide valuable information about market feelings, liquidity and potential prices movements.

Types of order flow data

Several types of order flow data are available:

- Distributed bid offers : Difference between offer price (minimum price that the investor is ready to sell) and ASK (maximum price that the investor is ready to buy).

- Order Book Data : Provides information on all orders set at a particular price level, including offers and search prices, volume and time.

- Depth Data on the market : offers insight into the market liquidity, including the number of customers and sellers at each price level.

Using a flow of order for information on trade decisions

Analyzing the order flow data, traders can acquire valuable insights that help them make informed trading decisions. Here are some ways in which order flow data may benefit from cryptocurrency trading:

- Identify the pressure of purchases and sales

: analysis of the expansion data and printing data can reveal whether there is a purchase or sale of pressure on the market. If the expansion of the offer is widely wide, it may indicate a lack of trust among merchants.

- Understand feelings on the market : Order flow data provide insight into market feelings. A large number of orders to buy at a particular level price may indicate strong bull feelings, while a large number of sales orders can suggest bear feelings.

- Identify the influence and volatility : analysis of the order book data can help traders identify the possibilities of using the market liquidity, as well as potential risks associated with great volatility.

- Predict pricing : by analyzing your order flow data over time, traders can recognize patterns that may indicate future prices movement.

How to use the order flow data

To start using the order of order of order to better trade insights, follow these steps:

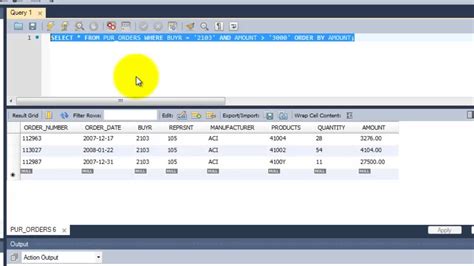

- Select trading platform : Choose a reputable trading platform that offers access to the order book and market depth.

- Set warnings : Set alerts for certain events, such as changes in the expansion or order data.

3

- Use indicators and tools : Use indicators and tools provided by your trading platform to help you make informed trading decisions.

Examples of order flow analysis in the Crypto Currency

Here are some examples of how cryptocurrency traders can use the order of order flow to inform their trading decisions:

- Analysis of Bookin Book Data ORDER : The merchant may notice that there is a large amount of order to buy in the amount of $ 30,000 and a low number of orders for sale at the same price level.

- Identification of bears’ feelings

: The merchant notes that there are many orders to buy above $ 40,000 with only a few orders for sale below $ 35,000. This may indicate bears in the market.

Conclusion

The use of the order flow data can provide dealers and investors with a valuable insight into the KRIPTO -valuta market. Analyzing the expansion of the-ASK, information on the order of the market depth and information information, traders can recognize the pressure of shopping and sales, understand the mood of the market and anticipate the movement of prices.