Unlocking of the power of the order flow for better commercial intuitions of cryptocurrency

Cryptocurrencies have revolutionized the way we think of trading and investments. With the rise of decentralized exchanges (Dexs), margins trading and other innovative platforms, traders and investors now have access to a wide range of tools and strategies to browse with confidence in the markets. One of these tools is the analysis of the flow of orders, which can provide valuable information on market dynamics and help you make more informed investment decisions.

What is the flow of order?

The order flow refers to the movement of purchase and sale orders through different exchanges, brokers or platforms. It is a key indicator that reveals how the traders are positioning themselves in various markets. By analyzing orders flow data, it is possible to obtain a deeper understanding of feeling, trends and potential market opportunities.

Why use the order flow for commercial information?

- Mercato feeling : The order flow data provide a instant feeling of the market, indicating if buyers or sellers dominate the market.

2

- Risk management : By understanding where operators are making their orders, it is possible to better manage the risk and limit losses.

- Optimization : the analysis of the order flow can help you optimize your trading strategies, minimize unnecessary transactions and maximize profits.

How to use the order flow for better trading intuitions

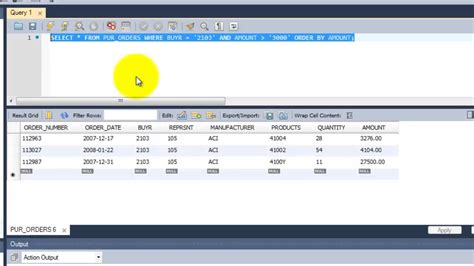

- Understanding the order flow platform : familiarizing with the platform order flow data, including purchase and sale orders, operations and market movements.

2

- Analyze the tendencies of the flow of orders : seek tendencies in order flow data, such as increases in purchase or sale orders, to evaluate the feeling of the market.

- Use automatic learning : use automatic learning algorithms to analyze large data sets and identify the models in order flow data that can inform trading decisions.

5

Popular tools for the analysis of the order flow

- Coinigy

: a popular cryptocurrency analysis platform that offers flow flow data in real time and automatic learning capacity.

- Cryptoslate : A cryptocurrency trading platform that provides analysis of the order flow and market insights.

3

Best Practice for the use of the order flow

1

- Use more sources of order flow data : combine multiple sources to obtain a more complete understanding of market dynamics.

- Avoid excessive interpretation

: be cautious in order not to excessively interpret the results, since the analysis of the flow of the order can be complex and nuanced.

- Take other market indicators : in addition to orders flow data, consider other market indicators, such as fundamental technicians or analyzes, to obtain an all -round vision of the markets.

Conclusion

The analysis of the order flow is a powerful tool for trader and investors looking for better insights on trading. By understanding as buyers and sellers they are positioning themselves in various markets, it is possible to obtain valuable information on market trends, feeling and risks management strategies.