Market successors: Understand its impact on cryptocurrency prices

The world of cryptocurrencies has become increasingly volatile in recent years, and prices fluctuate from one day to another. While many investors meet for short -term benefits, there is another group that often plays a crucial role in price movements: a market forums.

In this article, we will deepen the market concept and explore its important impact on cryptocurrency prices. We will also test some key characteristics, risks and strategies for market actors who wish to navigate this dynamic.

Who are marketing specialists?

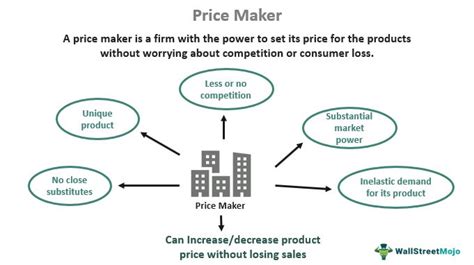

Market successors are individuals or authorities who buy and have large amounts of cryptocurrencies at the current price, with the aim of selling them when the price falls. They often act as market manufacturers, which take care of both sides to benefit from price movements.

In other words, the market to those who give them as a “price acquisition”, which means that they cannot control prices or influence their direction through their own purchase or sale activities. Instead, they trust the collective behavior of the market and the actions of other merchants to dictate the price movement.

Characteristics of market sorches

To succeed as a market participant, the individual or the institution must have certain qualities:

1

Large sales : Market successors must have a significant amount of cryptocurrency in their accounts to use market fluctuations.

- Flexibility : They should be able to adjust their purchase and sales strategies in response to changing market conditions.

3

Risk management skills

: Market successors must be able to manage their risk effectively, since they often experience losses if the price is too low.

How do people in the market affect cryptocurrencies?

Market successors play a fundamental role in cryptocurrency price movements. Here are some ways in which they can influence prices:

- Price discovery : When buying and maintaining large amounts of cryptocurrencies, market participants help establish market prices using their activities.

- The imbalance of supply and demand : If the market market buy cryptocurrencies at a low price, it can attract more buyers, causing price increases. On the contrary, if they sell at a higher price, this can lead to a price drop.

3

Market mood : market purchase and sale activities can affect market mood, since its shares often reflect the collective mood of the market.

- Order flow : Market successors help manage the flow of orders that is the market to buy and sell orders.

Risks associated with the market -Successors

While market successors have a significant impact on cryptocurrency prices, they also have risks:

1

Loss : If market participants do not quickly adjust purchase or sale strategies, they may suffer losses if the price falls too low.

- Market volatility : The market is essentially volatile, and market forces must be ready to adapt to changing conditions to maintain their profit potential.

3

Competition of other market participants : In a cryptocurrency market full of people, market -based successors can face intense competition to buy and sell opportunities, which makes it difficult to succeed.

Strategies of market participants

If you are considering participating in market participants, here are some strategies to consider:

1

Diversification : Extend your transactions in various kinds of cryptocurrencies or assets to reduce risk exposure.

- Risk management : Install the clear guidelines for risk management and attach to them, even taking into account market volatility.

3

Flexibility : be prepared to adjust your strategy in response to changing market conditions.

4.